HMRC notes (pages 24/26) ct600-guide

Note:

When losses surrendered as Group Relief or EUFT are entered into the boxes on the Losses etc. screen, the values are deducted from losses carried forward.

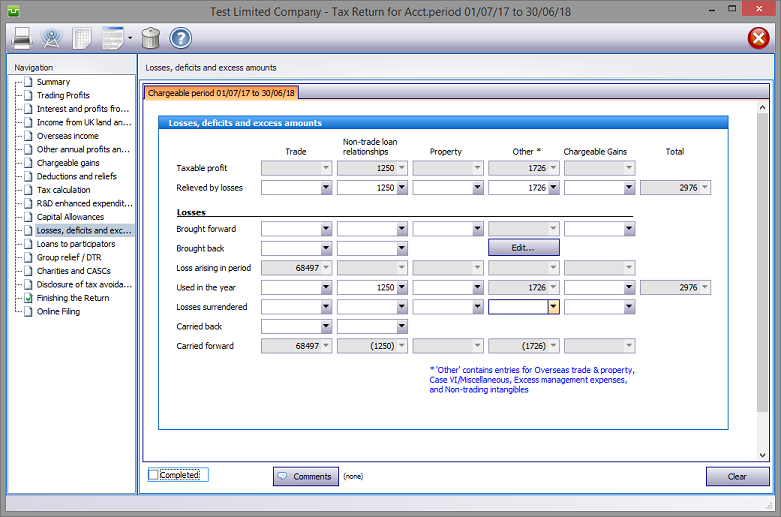

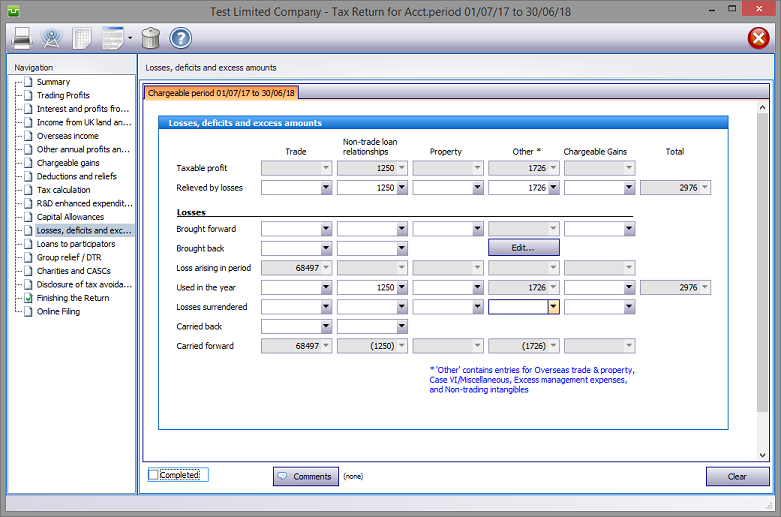

In the Navigation pane click on Losses, deficits and excess amounts and complete as appropriate.

Important:

The Relieved by Losses (against profits) boxes are used to indicate the allocation of losses against the various profit sources. Entries must also be made in the Used in the year boxes since it is from these that the program calculates chargeable profits etc.

Only make entries in the Used in the year boxes where actual losses exist for that source. Note, that in the example above, an entry is made in the Trade column since it is only trading losses that are available to cover taxable profits totalling £2,976.

Note:

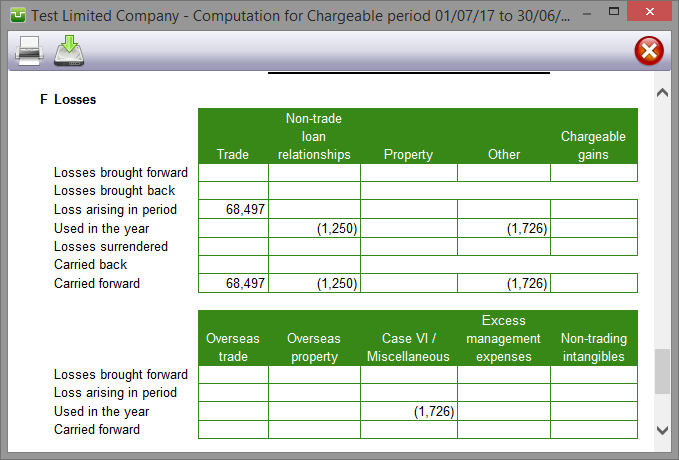

Calculation

Computation summarises losses etc.

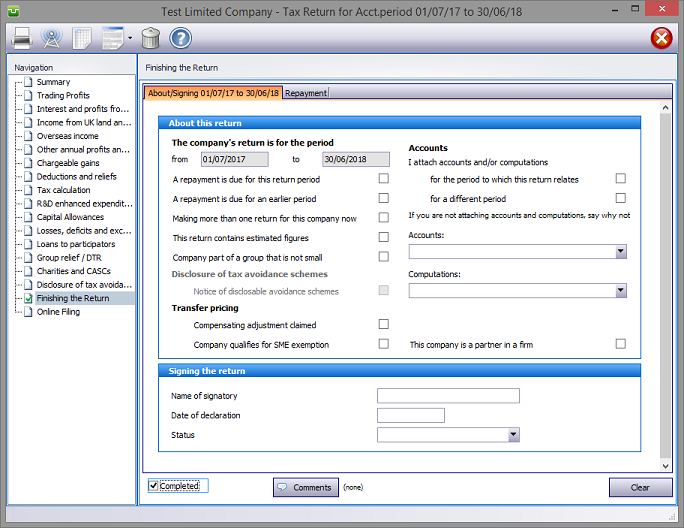

Finishing

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

Entries made via Comments are for information only and do not appear on the return. The first few words of additional information/comments appear to the right of the relevant boxes.

(pages 24/26) ct600-guide

Copyright © 2025 Topup Software Limited All rights reserved.